The Month Ahead: January 2026

Strong earnings meet the bond market vigilantes.

The first half of January was defined by the "January Effect" optimism; the second half will be defined by a brutal reality check from the bond market. With the 10-Year Treasury Yield (TNX) spiking to 4.23%—a four-month high—equity valuations are facing their stiffest test since September. The catalyst isn't just economic data; it's the political signal that President Trump favors the hawkish Kevin Warsh for Fed Chair, potentially upending the "easy money" narrative.

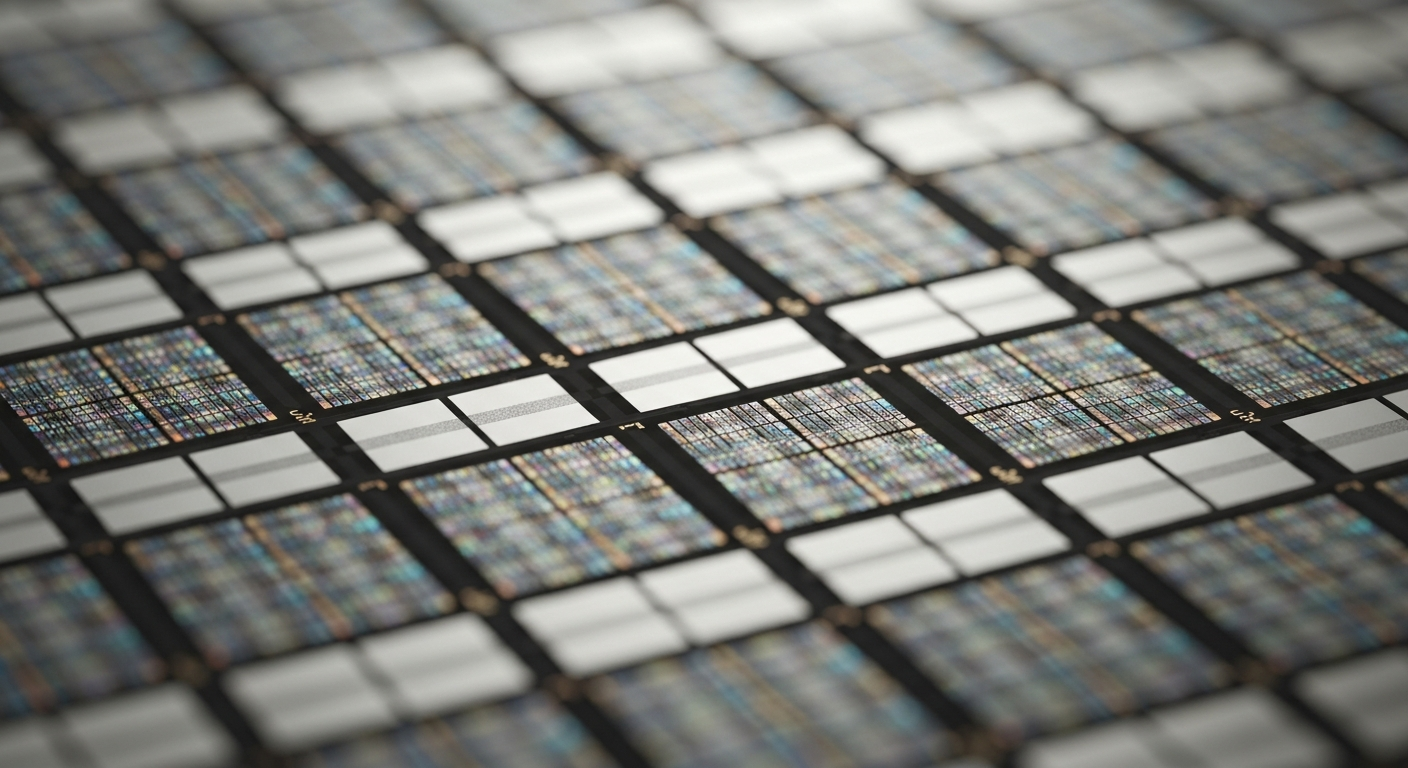

The central tension for the remainder of January is clear: Can accelerating AI fundamentals, evidenced by Taiwan Semiconductor ($TSM) surging 4.4% on blowout earnings, overpower the valuation compression caused by rising rates? We are entering the thick of earnings season with the S&P 500 (GSPC) trading at elevated valuations. In a 4.25%+ yield world, perfection is priced in, but the cost of capital is rising.

What December Taught Us

December closed with the S&P 500 (GSPC) cementing a strong year, driven by the belief that inflation was conquered. The December CPI print of 2.6% (lowest since March 2021) seemed to validate the "soft landing" thesis. However, the lesson from late December was complacency: markets priced in aggressive rate cuts that the data—and now the political landscape—are rapidly pricing out.

Winners & Losers

- Outperformers: Micron Technology ($MU) and the broader semiconductor complex (+7.8% reaction) proved the AI capex cycle has legs.

- Underperformers: Utilities and Rate-Sensitives. Constellation Energy ($CEG) slumped 10% on policy fears, highlighting the sector's vulnerability to both rates and regulatory shifts.

The Lesson: Macro policy risk is back. The "Fed Put" is not guaranteed under a new administration potentially prioritizing hard money.

Catalyst Calendar

Week 3: Jan 19-23 (Earnings & Inauguration)

- Jan 20: Presidential Inauguration. Markets will parse the speech for trade and fiscal policy specifics.

- Jan 20 (Tue): Earnings from Netflix ($NFLX) and United Airlines ($UAL).

- Jan 22 (Thu): Earnings from Intel ($INTC) and Procter & Gamble ($PG).

- Jan 22 (Thu): US Q4 GDP (Advance Estimate). Forecasts suggest a robust 4.3% growth rate.

Week 4: Jan 26-30 (Big Tech & Fed Prep)

- Jan 27-29: Peak earnings volume. Focus shifts to Mega Cap tech guidance.

- Jan 30: PCE Inflation data (Fed's preferred metric).

Synthesis: The final two weeks of January are the most dangerous. We have the "Inauguration Volatility" overlapping with a GDP print that could push yields even higher if it confirms the 4.3% growth estimate.

Sector & Factor Setup

The rotation is violent and swift. Momentum is clearly residing in Semiconductors and Hardware, while defensive proxies are being liquidated.

Momentum Favors

Mean Reversion Candidates

- Utilities: The 10% drop in Constellation Energy ($CEG) looks like capitulation, but policy risk remains a falling knife.

- Real Estate: Highly sensitive to the 10Y move above 4.20%.

Factor View: "Growth at Any Price" is out; "Growth with Cash Flow" is in. The market is punishing leverage (Utilities) and rewarding balance sheet fortress (Tech).

Flows & Positioning

Institutional positioning is stretched but not exhausted. The "pain trade" has shifted from FOMO (Fear Of Missing Out) to fear of duration.

- Systematic/CTA: Trend followers are caught in a bind. Long equity signals remain, but the breakdown in bonds (short price, long yield) is triggering volatility control mechanisms that may force equity selling.

- Hedge Fund: Net leverage remains high, but rotation out of software into hardware is evident in the Micron ($MU) flows.

- Retail: Still chasing. Crypto flows remain robust with Bitcoin holding $95k, signaling risk appetite hasn't fully soured yet.

Implication: If the 10-Year Yield breaks 4.30%, expect systematic funds to de-lever equities to manage portfolio volatility targets.

The Risk Landscape

Primary Risk: The "Warsh Tantrum"

The bond market is violently repricing the probability of Kevin Warsh replacing Powell. Warsh is viewed as a monetary hawk who may prioritize price stability over full employment. If Trump confirms this nomination, the 10-Year yield could test 4.50% rapidly, compressing S&P 500 multiples.

Secondary Risks: Grid Policy Shock. The 10% drop in Constellation Energy ($CEG) and 8% drop in Vistra ($VST) shows that the Trump administration's plan to "shake up" the electricity grid is a live grenade for the AI-energy thesis.

Hedging: With VIX (VIX) relatively muted at 15.86 (+0.13%), put protection is still cheap. Skew is rising, suggesting smart money is bidding up downside protection while keeping long exposure.

Disclaimer: This content is for informational and educational purposes only and does not constitute financial advice, investment advice, or any other type of advice. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.