The Open

The AI trade isn't dead; it just needed a $250B catalyst.

The S&P 500 (GSPC) paused for breath at 6,940 (-0.06%), caught between a reignited semiconductor rally and the reality of a 22.2x forward multiple. While the broad index consolidated, the engine room of the market roared back to life: a massive $250B US-Taiwan trade pledge sent Super Micro Computer ($SMCI) surging 11%, offsetting a mixed reaction to bank earnings. The key tension for the week ahead: Can the AI infrastructure boom justify valuations that are now trading well above the 5-year average?

Overnight Action

Friday's close set the tone for the weekend, with U.S. markets finishing essentially flat as the Nasdaq Composite (IXIC) dipped 0.06% to 23,515. The semiconductor complex outperformed significantly, driven by the dual tailwinds of robust TSMC results and the new trade framework. Dell Technologies ($DELL) added 0.73% to $120.53, while legacy tech lagged, with Hewlett Packard Enterprise ($HPE) shedding 2.32%. The session was defined by rotation rather than retreat, as capital moved from rate-sensitive sectors into the renewed AI momentum trade.

What We're Watching

The AI Renaissance Trade

Traders are aggressively positioning for a "second wave" of AI infrastructure spending following the announcement of a $250B US-Taiwan trade deal. The agreement, promising massive investment in American production, has reignited the capex narrative that cooled late last year. Options markets are seeing renewed call buying in server makers and chip designers, betting that government-backed production will accelerate hardware deployment.

- Key Level: S&P 500 6,950 (immediate resistance)

- Upside: Breakout targeting psychological 7,000 level

- Downside: 6,900 support zone if valuation concerns resurface

- Invalidates If: Trade deal details disappoint or implementation delays emerge

Top Stories

Geopolitics, earnings, and personnel moves converge in this weekend's key narratives.

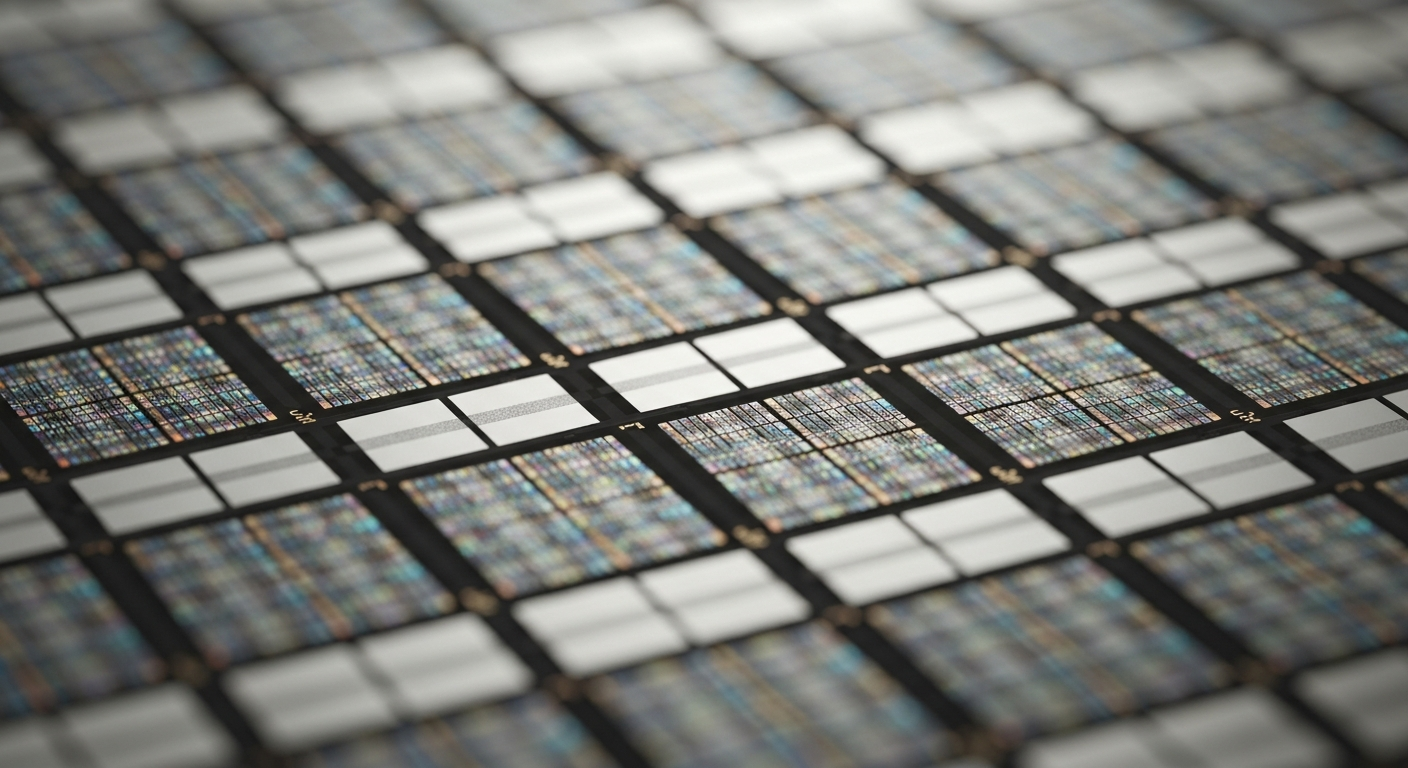

$250B Trade Deal Ignites Chip Rally

The U.S. and Taiwan have agreed to a trade framework promising $250 billion in investment focused on American production capacity. The news, combined with strong results from TSMC, sent Super Micro Computer ($SMCI) flying 11.01% to $32.66. The deal is viewed as a direct subsidy for the AI hardware supply chain, reducing geopolitical risk premiums.

Why It Matters: It supports the "onshoring" thesis and provides a tangible capex roadmap for the next 2-3 years.

Market Impact: Broad semi-equipment rally; SMCI and DELL outperforming legacy hardware.

Bank Earnings: Good, But Good Enough?

JPMorgan Chase ($JPM) delivered a solid Q4 with revenue of $46.8 billion (+7% YoY) and EPS of $4.63. Bank of America ($BAC) also beat, posting $28.4 billion in revenue (+7%) and $0.98 EPS (+18% YoY). Despite the beats, price action was muted, suggesting the "higher for longer" net interest income benefit is fully priced in.

Why It Matters: Financials are the market's reality check; strong numbers with muted stock reactions often signal exhaustion.

What to Watch: Forward guidance on loan loss provisions in the coming week.

Fed Chair Speculation Heats Up

President Trump signaled he may keep Kevin Hassett in his current economic advisor role, clearing the lane for former Fed Governor Kevin Warsh to emerge as the frontrunner for Fed Chair. Markets generally view Warsh as a more traditional, perhaps slightly more hawkish, institutionalist compared to other candidates.

Why It Matters: Leadership certainty reduces volatility, but a Warsh appointment could re-anchor rate expectations higher.

Next Catalyst: Official nomination announcement.

Positioning

Flows: The S&P 500 is currently enjoying its 10th consecutive quarter of year-over-year earnings growth, a streak that continues to attract passive inflows despite valuation concerns. Institutional capital is rotating back into hardware names, chasing the SMCI breakout.

Sentiment: Caution is creeping in regarding valuations. The S&P 500 forward 12-month P/E ratio stands at 22.2x, significantly above the 5-year average of 20.0x. This "valuation premium" leaves little room for earnings disappointments.

Today's Calendar

- Economic Data: Weekend Review - No releases scheduled.

- Earnings: Focus shifts to regional banks and tech follow-throughs next week.

- Fed Speakers: Monitoring comments on Warsh vs. Hassett speculation.

Risk Watch

Valuation Vertigo

With the S&P 500 trading at 22.2x forward earnings, the market is priced for perfection. The primary risk is not a collapse in fundamentals, but a compression in multiples if yields rise or growth decelerates. A reversion to the 5-year average of 20.0x would imply a ~10% correction in the index, even if earnings estimates remain stable. Watch the 6,900 level as the first line of defense for the bulls.

Disclaimer: This content is for informational and educational purposes only and does not constitute financial advice, investment advice, or any other type of advice. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.