Week in Review

Small caps partied while the bond market flashed yellow.

The large-cap rally hit a wall of rising yields this week, as the 10-year Treasury note climbed to 4.23%, pressuring valuations at the top of the market. While the S&P 500 (GSPC) and Nasdaq Composite (IXIC) retreated from highs, a distinct rotation took hold: investors pivoted aggressively into small caps and semiconductors. The divergence was stark—while the broad market digested mixed bank earnings and political uncertainty regarding the next Fed Chair, the Russell 2000 (RUT) surged to fresh records.

The Scorecard

Equities

- S&P 500: -0.38% → 6,940.01

- Nasdaq Composite: -0.66% → 23,515.39

- Russell 2000: +2.0% → Record High

- Dow Jones: -0.17% (Friday) → 49,359.33

Rates & Macro

- 10Y Yield: +6 bps → 4.23%

- CPI (Dec): Headline +2.7% (In-line), Core +2.6% (Beat)

- Retail Sales: Core +3.58% YoY

Day by Day

- Monday-Tuesday: Markets consolidated ahead of key inflation data, with positioning leaning cautious.

- Wednesday: CPI landed in the Goldilocks zone (Core +2.6%), initially soothing inflation fears before yields began to creep higher.

- Thursday: Bank earnings kicked off with a split verdict—JPMorgan Chase ($JPM) impressed, while others stumbled.

- Friday: Yields spiked to 4.23% on reports that President Trump favors hawk Kevin Warsh for Fed Chair, pushing the S&P 500 to a weekly loss despite strong semiconductor action.

What Worked

Domestic cyclicals and AI infrastructure plays decoupled from the broader market malaise.

- Small Caps: The Russell 2000 (RUT) gained 2.0%, benefiting from the "domestic growth" trade and rotation out of crowded mega-caps.

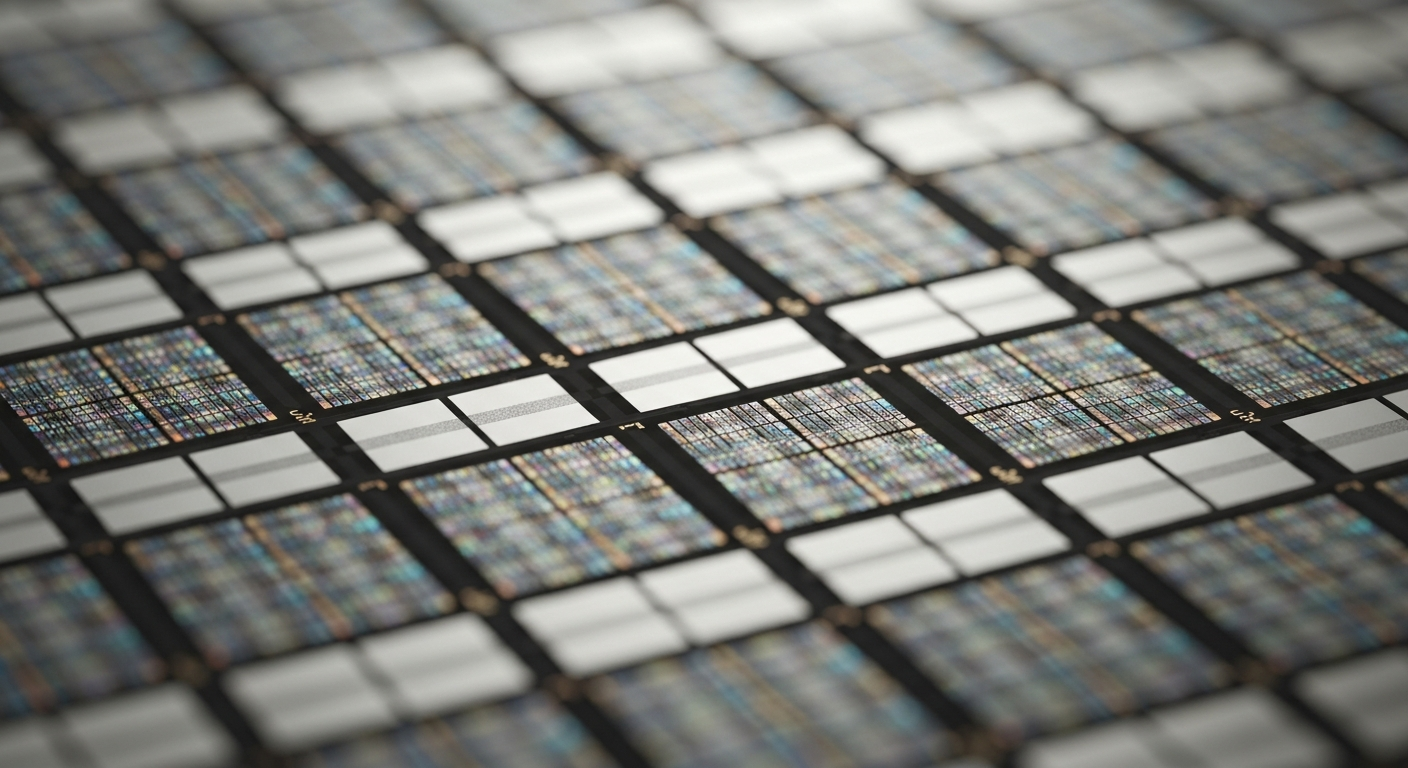

- Semiconductors: TSMC's massive capex hike lifted the entire value chain. Micron Technology ($MU) surged 7.8% and Broadcom ($AVGO) added 2.5% as AI demand visibility improved.

- Quality Financials: JPMorgan Chase ($JPM) proved why it trades at a premium, delivering a 7.6% earnings beat ($5.23 vs $4.86 est) and robust guidance.

What Didn't Work

Rising rates and execution errors punished specific pockets of the market.

- Revenue-Miss Banks: The rising tide did not lift all boats. Wells Fargo ($WFC) fell ~2% and Citigroup ($C) dropped over 4% after both missed revenue estimates, highlighting the divergence between winners and losers in financials.

- Broad Tech Indices: Despite the semi surge, the broader Nasdaq Composite (IXIC) fell 0.66% as higher yields (10Y @ 4.23%) compressed valuations for long-duration software and consumer tech names.

Week Ahead Setup

Markets enter next week with a clear tension: strong economic data vs. tightening financial conditions via yields.

Key Catalysts

- Fed Chair Nomination: The Trump administration's choice (Warsh vs. Hassett) could violently reprice the bond market.

- Earnings Acceleration: The reporting season broadens beyond banks to key cyclical names.

- Geopolitics: Watch for retaliation regarding the proposed tariffs on 8 European nations over the Greenland dispute.

Levels to Watch

The S&P 500 needs to reclaim 7,000 to negate the weekly reversal. On the downside, 6,900 remains the key support level to hold.

Disclaimer: This content is for informational and educational purposes only and does not constitute financial advice, investment advice, or any other type of advice. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.