Markets

MarketsMorning Brief: SMCI +11% on $250B Deal; S&P Stalls at Valuation Wall

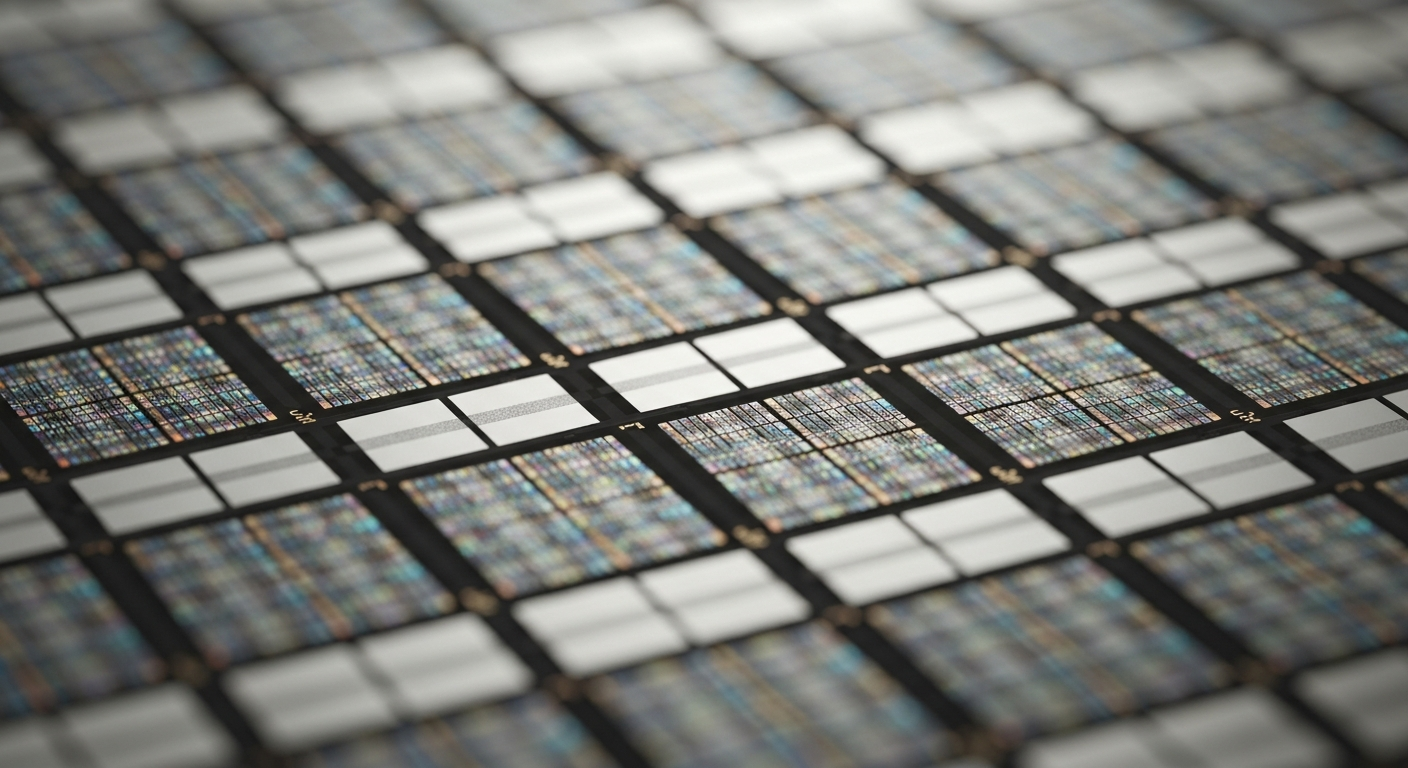

A massive $250B US-Taiwan trade pledge reignited the AI infrastructure trade, sending Super Micro Computer (SMCI) surging 11% to $32.66 while the broader S&P 500 stalled at 6,940. Despite strong earnings beats from JPMorgan ($46.8B revenue) and Bank of America (+18% EPS), financial stocks saw muted action, confirming that the "higher for longer" net interest income benefit is fully priced in. The divergence is stark: capital is aggressively rotating from value sectors back into hardware capex plays, even as the S&P 500 trades at a precarious 22.2x forward P/E—significantly above the 20.0x historical average. Elsewhere, ImmunityBio (IBRX) rocketed 40% on revenue data, signaling speculative appetite for organic growth outside the tech complex. Watch the 10-year yield as Fed Chair speculation shifts toward Kevin Warsh; a "hawkish institutionalist" appointment could challenge the valuation premium currently supporting the index.